With recent announcements on disclosure requirements and guidance from the SEC, California, and SBTi, the relevance of Scope 3 emissions (those within a company’s supply chain) has taken a variety of conflicting twists and turns. This has left many wondering: Do they still matter?

Perhaps most notably, the U.S. Securities and Exchange Commission finalized its long-awaited and much-debated climate-disclosure rule. While many expected the SEC to follow California’s lead related to Scope 3 disclosures, the final SEC ruling excluded a proposed requirement that companies report Scope 3 greenhouse gas emissions.

What does this mean for the future of Scope 3?

In a victory for ag, producers may now be safe from providing annual farm-level data to companies far up the value chain. However, more likely than not, Scope 3 at large will continue to remain important for major companies with ag-based supply chains. Here’s why:

Many companies have already made public abatement commitments.

> Ceres’ Food Emissions 50 Company Benchmark revealed that 37 out of the 50 companies listed have reported their supply chain greenhouse gas emissions, and that 32 of them have set targets to reduce those emissions.

> Leading consumer facing brands will still be looking for Scope 3 reductions and removals. According to the Science Based Targets Initiative, the number of companies setting greenhouse gas reduction targets doubled in 2023, reaching 4,204 at year end 2023, up from 2,079 at year end 2022. Scope 3 accounting, reporting, and change is a critical requirement of these commitments, which most major grocery retailers and quick service restaurants have set.

State-level required disclosures will impact many companies.

> Quantitative Scope 3 disclosures will continue to become more prevalent. Despite the SEC’s drop of Scope 3 reporting, California – the 5th largest economy in the world – has adopted a state-specific climate disclosure law that will require companies with at least $1 billion in revenue to begin reporting on Scope 3 emissions in 2027.

Scope 3 practices remain as valuable as Scope 3 outcomes.

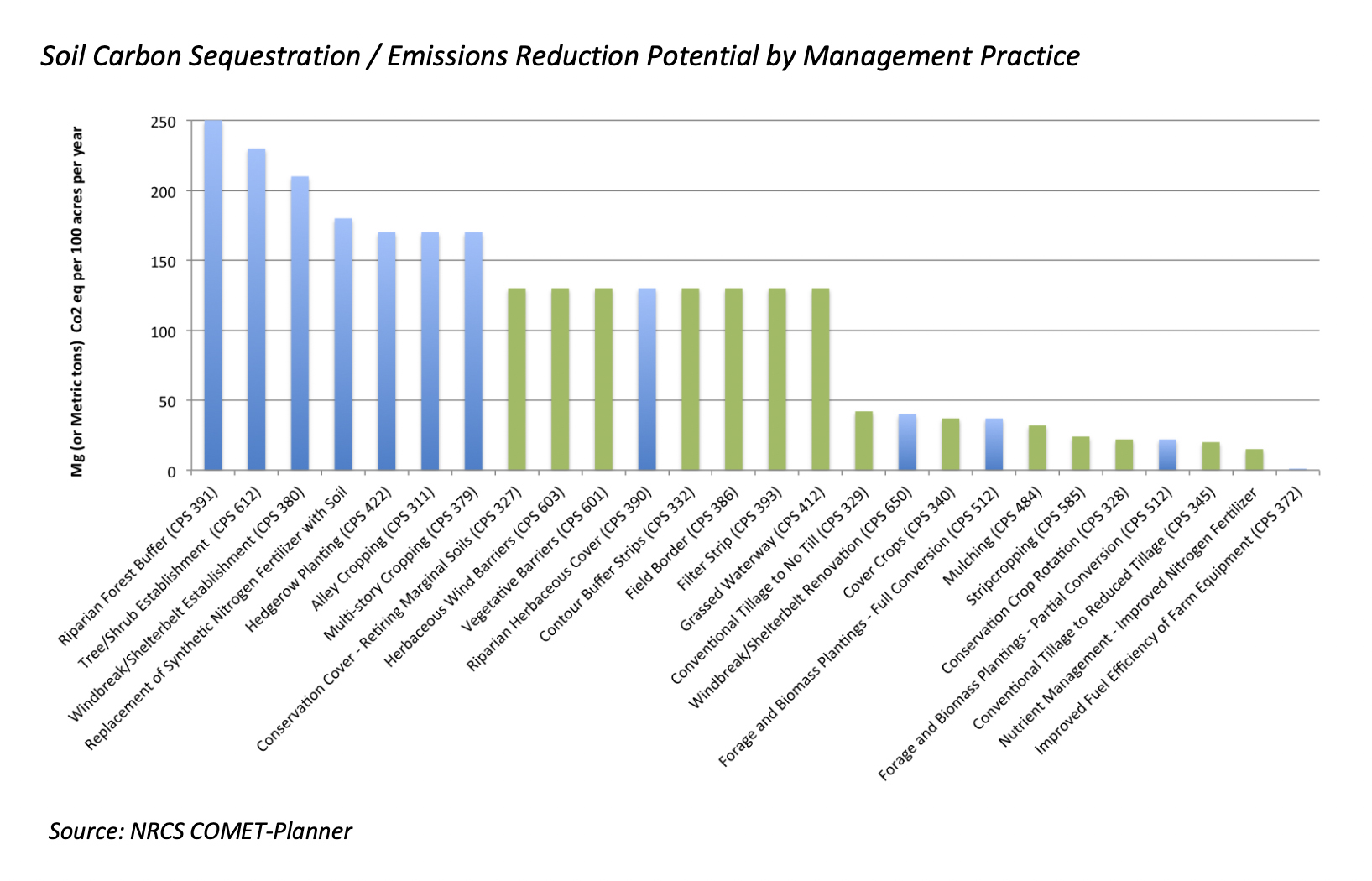

> According to AgFunder, nearly 40 of the world’s leading food and agriculture companies have made regenerative agriculture commitments – most of which focus on increasing acreage on which low-carbon practices are adopted to generate Scope 3 progress.

Read More >>> Ag Groups Respond to SEC Rule

- https://www.farmprogress.com/farm-policy/ag-groups-applaud-sec-emissions-rule-change

- https://www.agri-pulse.com/articles/20772-in-win-for-ag-groups-sec-scales-back-climate-disclosure-rule

- https://www.dtnpf.com/agriculture/web/ag/news/business-inputs/article/2024/03/06/final-sec-emissions-reporting-rule

About the Author

Zach Pinto | Director of Carbon and Ecosystem Service Markets

Zach promotes company strategy and client success by assisting industry groups, food and ag companies, and farmers on their sustainability goals. Zach has worked on carbon issues for stakeholders across the agriculture value chain and in a wide array of commodities, developing expertise in farm-level carbon accounting, MRV platform usage, voluntary and compliance market schemes, science-based targets, ESG reporting, and strategic planning.

Visit the SustainAg Network

Visit the SustainAg Network